The income tax slabs for a financial year are announced by the finance minister every year in the Union Budget. The income tax slabs and rates announced are applicable for the upcoming financial year. Usually, the finance minister makes an announcement in the month of February (when the budget is announced) and once the law is passed by the parliament, it becomes effective from April of that calendar year. An income tax is a sum that every Indian citizen, whether an individual or a business, is required to pay to the Indian income tax authorities for the fiscal year that begins on April 1 and ends on March 31 of the following year. The rate is determined by the government.

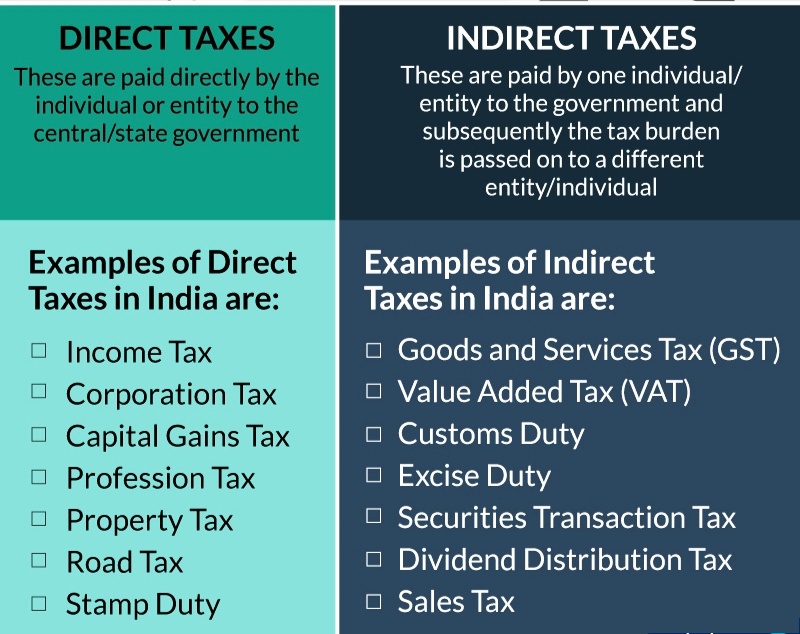

Broadly taxes are divided into two categories:

1. Direct Taxes

2. Indirect Taxes.

Goods and Services Tax:

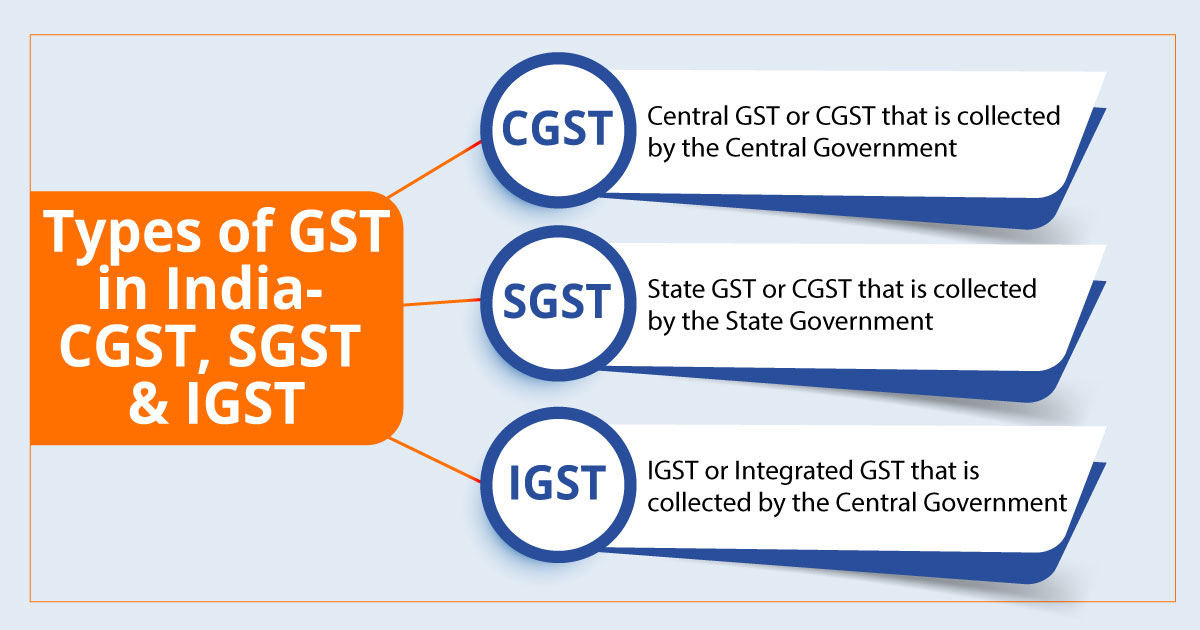

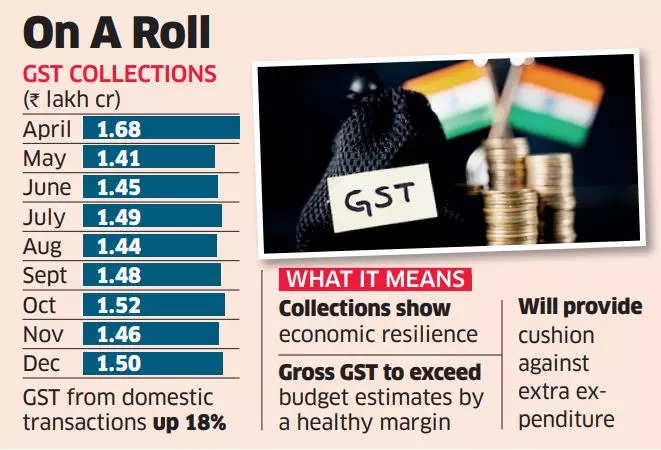

Goods and Services Tax (GST) is an indirect tax (or consumption tax) levied in India on the supply of goods and services. It is levied at every step in the production process.

The tax is divided into five slabs — 0 per cent, 5 per cent, 12 per cent, 18 per cent, and 28 per cent.

Although GST is collected by the central government, taxes on petroleum products, alcoholic drinks, electricity are separately collected by the state government.

What is Income Tax:

It is levied on a Hindu Undivided Family or an individual’s net taxable income during a fiscal year that begins on April 1 and ends on March 31 of the following year.

It is calculated using an individual’s or a business’s net taxable income.

The government of India has set certain slab rates, i.e., higher and lower slab rates, for the convenience of its citizens.

The government announced a new regime of income tax which is optional in Union Budget 2020-2021.

Tax Slabs In India:

Indian Income tax levies tax on individual taxpayers on the basis of a slab system. Slab system means different tax rates are prescribed for different ranges of income. It means the tax rates keep increasing with an increase in the income of the taxpayer. This type of taxation enables progressive and fair tax systems in the country. Such income tax slabs tend to undergo a change during every budget.These slab rates are different for different categories of taxpayers. Income tax has classified three categories of “individual “taxpayers such as:

Individuals (aged less than of 60 years) including residents and non-residents

Resident Senior citizens (60 to 80 years of age)

Resident Super senior citizens (aged more than 80 years).

Who all are liable to pay income tax in India:

Self-employed individuals

Salaried individuals

Hindu Undivided Family

Body of individuals

Association of Persons

Corporate firms or companies

Local authorities..

Corporate tax in India:

The Taxation Laws (Amendment) Bill, 2019 caused a reduction in the base corporate tax rate, that is, from 30 percent to 22 per cent for the existing businesses which led to revenue inference of INR 1.45 Lakh Crores. While, in case of new manufacturing firms that have been established post 1st October, 2019 and prior to 31st March, 2023, the base corporate tax was reduced from 25 per cent to 15 per cent.

According to reports, the corporate tax rates in India stand the lowest among other nations across the globe and the impact will be visible in the Indian economy in the upcoming years. This strategic action could possibly enhance the comparative adversaries of India’s corporation tax rates with other Asian nations.

The new corporate tax rates in India is much lower than USA (27%), Japan (30.62%), Brazil (34%), and Germany (30%) and for the new firms the tax rate is similar as of Singapore (17%).

No comments:

Post a Comment